Starting a mobile app may be a fascinating and profitable endeavour, but for most entrepreneurs, collecting the required money is a big obstacle. Financial support is crucial to fund development expenses, marketing, and continuous upgrades in a market where millions of applications fight for attention. Even the most creative app concepts might find it difficult to realize without enough money.

Whether your dream is to be a seasoned entrepreneur or a future app developer, knowing the financing scene, luring the correct investors, and properly presenting your concept will be very vital for success. Investors seek applications with a clear market need, a scalable business strategy, and a capable staff capable of carrying out the goal. By proving these elements, you raise your chances of getting funding to drive your app to become successful.

Key elements of mobile app funding—including ways to draw investors, pitching approaches, and expenses related to gaining investment—are covered in this extensive book. There are several paths to investigate, from bootstrapping and angel investors to venture finance and crowdsourcing. Securing the financial backing required to bring your mobile app to market and realize sustainable development will depend mostly on knowing which financing source fits your company objectives and producing a strong presentation.

Understanding Mobile App Startup Funding:

One should be aware of the many financing sources accessible to mobile app entrepreneurs before starting investor outreach. Turning a concept into a profitable product starts with raising money; hence, based on your company model and stages of app development, various financing sources provide special benefits. Ten frequently used financing options for mobile app businesses are listed here:

- Bootstrapping: Funding your app from personal savings or income from side businesses. This limits scalability but gives complete control.

- Friends & Family: Getting money from close friends who share your goal. Although this money source is easily available, it has personal connection dangers.

- Angel Investors: Individual investors who trade early-stage money for shares. Along with cash, they may supply mentoring and industry expertise.

- Venture Capitalists (VCs): Companies that make investments app development in startups with great expansion possibilities. They generally want great ownership and control even if they provide large financing.

- Crowdfunding: Public donations made on sites like Kickstarter or Indiegogo pay for incentives or equity. This will confirm your concept and guarantee financing.

- Government Grants & Subsidies: Using grants, innovation money, and tax incentives, certain nations provide financial assistance for tech businesses.

- Bank Loans & Lines of Credit: Conventional financing choices requiring interest-based payback. Startups with high-income expectations would find this approach well suitable.

- Accelerators & Incubators: Initiatives offering financing, mentoring, and networking chances. Early-stage companies looking for direction may find these helpful.

- Strategic Partnerships: Working with established businesses that could fund or support your app. This may provide market presence as well as financial support.

- Revenue-Based Financing: Funding is raised depending on projected future income. This lets entrepreneurs get money without sacrificing ownership.

Your knowledge of these alternatives and choice of financing plan will influence the success of your mobile app. Many app developers mix various sources to run and expand their company.

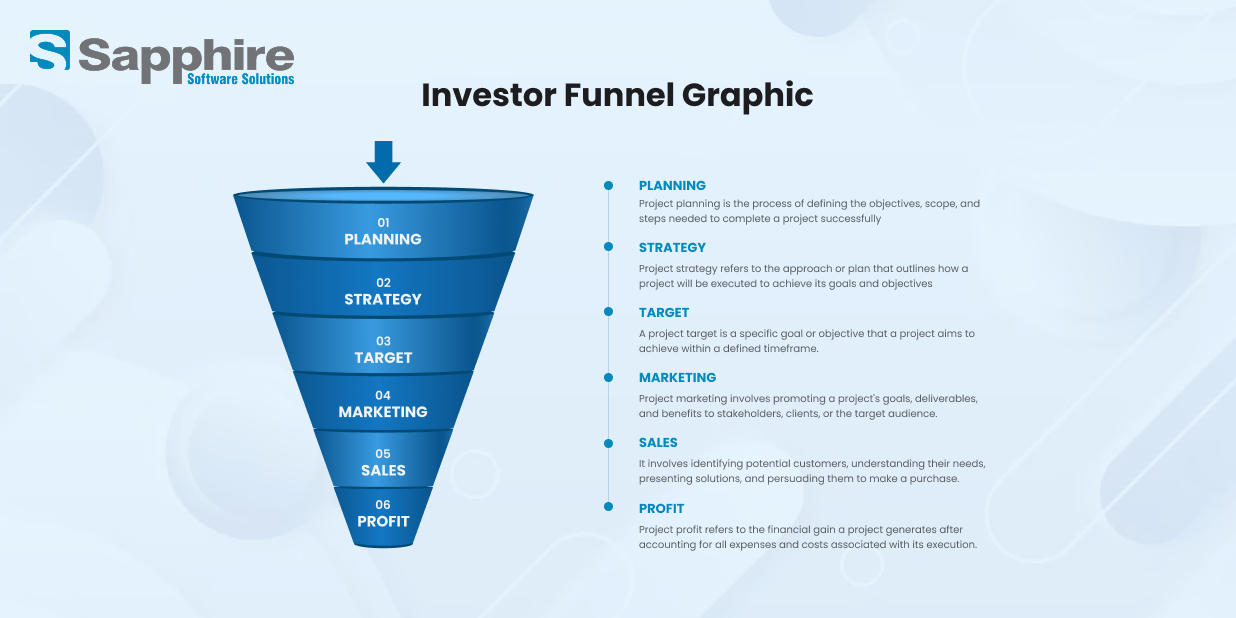

How to Attract App Investors for Mobile Apps:-

1. Develop a Comprehensive Business Plan:

Getting investor interest calls for a well-organized company strategy. Your strategy should succinctly state the idea, target market, income source, expansion goal, and competitive scene of your app. Investors want to see a scalable, environmentally friendly company model with long-term profitability possibilities. Emphasizing market research, possible consumer acceptance, and monetization techniques can help your company plan to be more interesting.

2. Validate Your Idea with Market Research & an MVP:

Investors are more willing to back a demand-generating app. Investigate closely the market to find your target audience, competitors, and industry trends. Creating a Minimum Viable Product (MVP) lets you evaluate the main features of your app, get user comments, and demonstrate its marketability. Early traction and actual user involvement help to increase investor trust greatly.

3. Create a Strong, Seasoned Team.

Attracting money depends much on a competent and well-rounded workforce. Investors choose companies with qualified experts who contribute development, marketing, and business strategy skills. Investors are reassured by a strong founding team with success history that the app has the leadership required to carry out the mission and properly negotiate obstacles.

4. Show Traction and User Engagement.

Investors search for concrete evidence your app is becoming popular. Showcase your app’s analytics, whether it already has users, makes money, or gets great comments. Key performance metrics include active users, retention rates, downloads, and income forecasts, which provide credibility and show the app’s market fit.

5. Use Networking to Your Advantage and Cultivate Investor Relations:

One of the best strategies available to interact with investors is networking. To establish rapport with possible investors attend industry events, app development startup contests, pitch evenings, and networking gatherings. Finding and contacting investors eager in mobile app entrepreneurs also depends on online sites such as LinkedIn, AngelList, and CrunchBase. Building a solid network raises your chances of finding the appropriate investor with your goal in line.

6. Make use of Web Fundraising Tools.

Online investing sites and equity crowding have simplified the process of drawing in funds. Startups may present their ideas to a larger audience of possible investors via websites such as SeedInvest, Crowdcube, and Fundable. Managing a successful crowdsourcing effort not only generates money but also confirms market interest in your app.

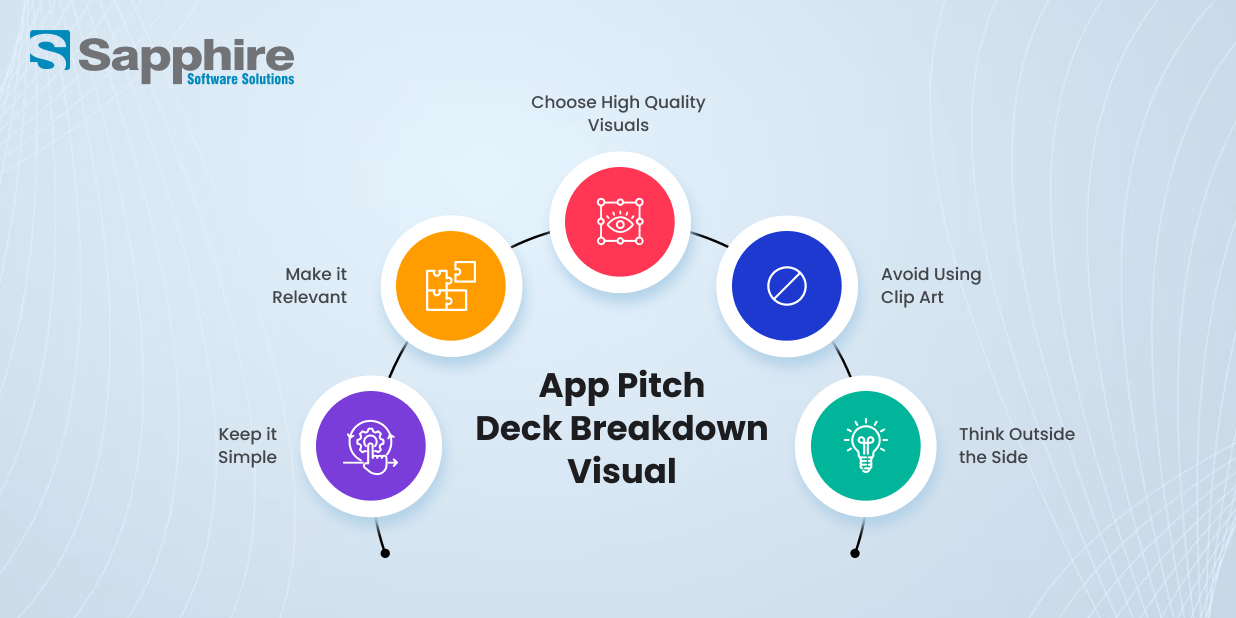

7. Design a Striking Pitch Deck.

Capturing investor attention calls for a well-prepared presentation deck to make money with mobile app. It should provide a summary of your app, the issue it addresses, market potential, competitive advantage, revenue model, traction, team, and financial needs. Keep it brief, appetizing visually, and supported by statistics. Effective investor meetings are built on a strong presentation deck.

8. Highlight Your Competitive Edge:

Investors have to know what distinguishes yours from the hundreds of daily releasing mobile applications. Stress the unique value proposition, technical creativity, and strategic benefits of your app above those of rivals. Presenting your competitive advantage can help you stand out, whether it’s using a proprietary algorithm, a specialized market, or a revolutionary company concept.

9. Clearly Present a Monetizing Plan.

Investors are curious about the income generating capability of your app. Specify exactly your monetizing strategy—subscription-based, freemium, in-app purchases, advertising, business licensing, etc. Show reasonable financial forecasts spanning projected income, spending, and profitability throughout time.

10. Ready for Due Diligence and Investor Questions?

Before investing money, investors will examine every facet of your company. Ready to respond to inquiries about the scalability, technology, marketing plan, and risk considerations of your app? Easily accessible for proper review are all required papers, including legal agreements, user statistics, and financial records. Investors trust transparency and preparation.

Pitching Mobile App Ideas to Investors:-

1. Start with a Strong Hook:

First impressions count, and grabbing an investor’s attention straight immediately is very vital. Open with a striking hook that precisely outlines the issue your app addresses. Show investors the practical effects of your solution and establish an emotional connection with them by means of narrative. A strong introduction will help your presentation to be memorable and establish the tone for success.

2. Specify the Market Opportunity.

Apps that cater to huge and expanding audiences are of interest to investors. Share statistically supported analysis of your target audience, industry trends, and possible market size. Show that your app has obvious demand as well as scaling possibilities. A well-investigated market possibility shows that profitability and capacity for expansion exist, therefore boosting investor confidence.

3. Explain Your App’s Core Features:

List the special features of your app and explain why it differs from rivals. Pay special attention to elements that directly solve the problems of your target market. Giving a visual demonstration or prototype could enable investors to grasp your offering better. Emphasizing creativity and usability in your app will help to increase its investment attraction.

Tell exactly how your app makes money. Talk about App Development Costs: What impacts the price? freemium alternatives, in-app purchases, advertising, or any other pertinent monetizing tool. Show throughout time anticipated financial growth and profitability. Investors look for a clear return on investment sustainable company model.

5. Presenting Traction & Validation:

An established, popular app is more likely to get funding from investors. Emphasize important performance markers such as downloads, active users, retention rates, and income data. Add to your proposal any secured relationships, media coverage, or favorable customer endorsements. Evidence of market validation guarantees investors of the possible success of your app.

6. Call Your Team:

For many investors, a great team determines everything. Show your important team members their prior performance as well as their knowledge. Showing a capable and experienced workforce helps investors know that your company has the proper individuals to carry out the mission and surmount obstacles.

7. Deal with Competitiveness and Competitive Advantage.

Every great app must contend with competition. Name your primary competitors and describe how your app sets itself apart. Emphasize whatever makes your app a better investment app choice—better technology, distinctive branding, or a first-mover advantage. Investors want to know you have a strong plan and hire promising Mobile App Development Services to stand out and that you grasp the competitive terrain.

8. Clearly Demand Funding:

Tell exactly how much you need to be invested and how the money will be distributed. Break down your spending—hiring Mobile App Development Agency, marketing, team building, and running expenses. A well-thought-out budget shows your strategic planning and financial sense.

9. Investor Questions: Prepare Yourself

Investors will probe difficult issues, so preparedness is very important. Count on questions about scalability, risk concerns, exit plans, and income forecasts. Respond with integrity and openness. A confident and well-prepared entrepreneur gives investors confidence and credibility.

10. Finish with a Robust Call to Action.

Finish your presentation with a strong synopsis of the reasons your app presents as a fantastic investment. Whether it’s a follow-up meeting, product demo, or more conversations, invite investors to go forward. To make a lasting impact, convey your vision’s confidence and excitement.

App Investor Presentation Tips:-

Here are some of the tips to use that will help you convince an app investors:

Craft a Compelling Story:

Your investor presentation should captivate prospective supporters with a relevant narrative. Beginning with a compelling story that emphasizes the issue your app addresses and user effect, A presentation that arouses emotions and shows a definite need in the market is more likely to pique the interest of investors. Keep your messages clear, targeted, and simple.

Structure Your Pitch Deck Effectively:

A good investor presentation depends critically on a well-ordered pitch deck. Incorporate the key slides like:

- Introduction: A synopsis of your app and goals.

- Clearly state the problem your app solves and the method it uses to arrive at a solution.

- Present statistics on target users, industry trends, and possible expansion indicate a market opportunity.

- Product Demo – Emphasize the usability and functionality of your app.

- Business Model: Describe the income generating mechanism of your app.

- Traction & Milestones – Emphasize user involvement, downloads, alliances, or early income.

- Competitive Landscape – Demonstrate how unique your app is among others.

- Go-To-Market Strategy: Describe strategies of consumer acquisition and marketing.

- Share predicted income, expenses, and profit margins in the finances and projections.

- Funding Ask & Use: Indicate the exact amount of money you need and the distribution of it.

Your mobile app pitch should solve a problem investors care about.

Engage Investors with a Strong Delivery:

Your presentation needs to be interesting, confident, and supported by facts. Steer clear of too technical language and emphasize intelligibility. Be ready to respond to investor inquiries using thorough research and reasoned analysis. Make eye contact, make good use of images, and guarantee your pitch is succinct yet strong. Hiring a good Mobile App Development Company in USA builds investor trust and helps your app to be a more appealing investment choice.

Angel Investors for Mobile Applications:-

Who Are Angel Investors?

High-net-worth people called angel investors provide early-stage money to firms in return for convertible debt or stock. Unlike venture capitalists, who pool money from many sources, angel investors encourage bright commercial ideas using their riches. Many angel investors are seasoned businesspeople or entrepreneurs with great mentoring and industry contacts combined with financial support.

Where to Look for Angel Investors?

Finding the ideal angel investor calls for focused networking and study. Look first at internet sites like local angel investor organizations, Gust, and AngelList. Connecting with possible investors might also come from attending industry conferences, accelerator programs, and company pitch events. Using personal and professional networks and hiring a reputed Mobile App Development Agency also greatly raises your chances of getting an investment.

Dealing with Angel Investors: Methodically

Emphasize to angel investors market need, scalability, and a clear income stream. Investors desire a solid founding team, early momentum, and a well-considered go-to-market plan. Ready to respond to inquiries about your financial forecasts, customer acquisition expenses, and competitiveness? Finally, make sure your presentation is succinct, interesting, and supported by facts to inspire investor faith in the possible capability of your mobile app.

Funding Tips for App Entrepreneurs:-

Start Small and Scale Gradually:

Many times, the initial phase for many entrepreneurs is bootstrapping. Maintaining complete control over your company by means of personal assets or income from other sources enables you. Before looking for outside funding, this app technique also aids in product improvement and market demand proof. Once you have some momentum, you may ask for early-stage grants or contact angel investors to get the first money.

Use Crowdsourcing for Market Validation.

Startups may raise money via crowdsourcing sites such as GoFundMe, Indiegogo, and Kickstarter, which also validate market interest. A properly run crowdsourcing effort may show demand for your app and attract early users. Moreover, effective campaigns can grab the interest of bigger investors, which facilitates the acquisition of more money.

Compare Equity to Convertible Notes:

Choose whether to employ convertible notes or stock while fundraising. Selling shares of your business to investors under equity financing gives them ownership interests. Conversely, convertible notes are loans that, sometimes at a reduced rate, turn into equity later. With the help of this app, entrepreneurs may postpone valuation conversations while still getting the funding they need.

Budget for Several Funding Rounds:

From pre-seed to Series A and beyond, most firms complete many rounds of financing. Clearly defined benchmarks in your financing plan will enable investors to grasp your expansion plan. In subsequent rounds, venture capital companies find your app more appealing if you show consistent traction and income generation.

Improve Your Pitch in Response to Investor Comments:

Pitching is an iterative process. Talk to possible investors, get comments, and then change your company strategy and presentation. Respond to investor issues and modify your plan to boost your chances of getting finance. An organized and flexible entrepreneur is more likely to draw in investors who see long-term possibilities in their app.

A compelling story and scalable product are key to securing app funding.

Conclusion:

Finding investors for mobile app development calls for both constant work and a well-organized approach. Whether bootstrapping, angel investors, venture money, or crowdsourcing, first determine the most appropriate financing sources. Create a great business strategy, assemble a capable team, and verify your app using an MVP and market research. Your prospects of drawing financing will be much raised by networking with investors and developing a strong case study.

Recall that investors search for firms with a well-prepared team, scalable business strategy, and unambiguous market needs. Your app will be positioned as a potential investment possibility by proving traction, showing financial estimates, and stressing your competitive advantage. Although the fundraising path may be difficult, with the right Mobile App Development Services from our team, tenacity, and smart planning, you will get the money required to launch your app and realize long-term success. Reach out to us now if you are looking for a Mobile App Development Partner.